[ad_1]

How assorted are the asset administration corporations controlling the endowments of the 50 wealthiest U.S. colleges and universities? Which is a question the Knight Basis set out to answer—but one that stays unclear, considering the fact that 34 of the 50 wealthiest institutions aren’t eager to communicate about it.

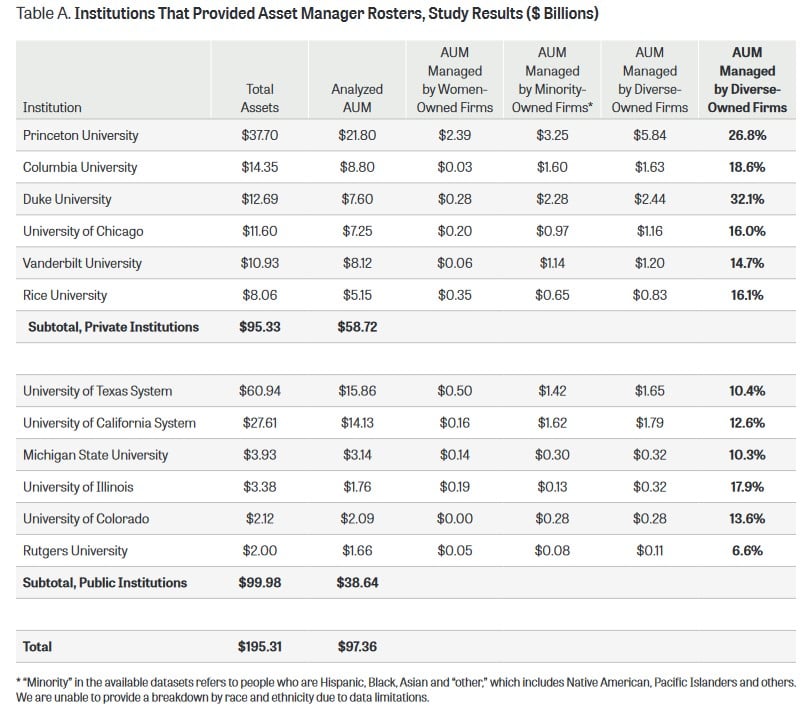

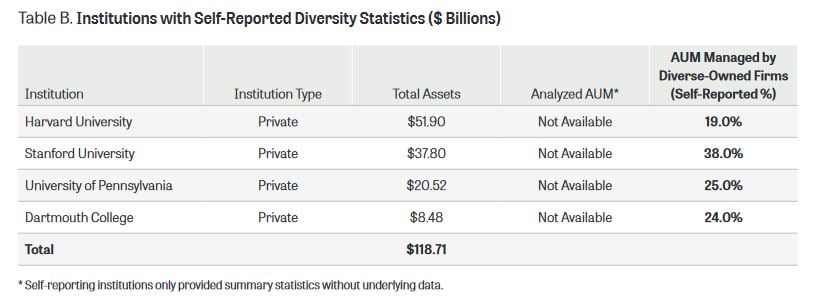

The investigate, which looks at the best 25 community and leading 25 personal universities, provides an incomplete photo, presented the underwhelming participation of establishments. Four colleges self-noted details, leaving only 12 universities that furnished asset manager rosters to the researchers.

But if an reply can be pulled from the limited information: their asset management corporations are not pretty varied at all.

The analyze, produced Thursday as an interim report owing to the deficiency of complete info accessible, was a joint effort by the Knight Foundation and the New York University Stern Center for Small business and Human Legal rights. It relied on investigation carried out by World-wide Economics Group, a organization management consultancy.

Unpacking the Study

Among the 16 universities that participated both partly or thoroughly, there are significant distinctions in variety. In accordance to Stanford University, which self-documented knowledge, 38 percent of its assets are beneath administration with various firms—the highest documented figure of any establishment in the research.

Duke College, which totally participated by sharing its asset management rosters with scientists, has 32.1 percent of assets in the fingers of varied companies.

On the reverse conclusion of the spectrum, assorted-owned corporations deal with 6.6 percent of Rutgers University’s property and 10.3 percent of Michigan State’s.

The report involves statements from some schools outlining their determination to numerous corporations. Other people opted to reveal why they chose not to take part their motives incorporate lack of staff to assemble the data and an inability to share proprietary information and facts. Some available no comment at all.

“Diversity, fairness, and inclusion are main values at Stanford University. Stanford Administration Organization (SMC), a small business unit of the College, is thoroughly engaged in Stanford’s diversity initiatives and has its have [diversity, equity and inclusion] Action Plan that can be found on its web page. SMC is dedicated to rising range amongst its personnel, growing upon the present variety of the endowment portfolio, and contributing to diversity in the asset management marketplace,” Stanford mentioned in a statement integrated in the Knight Basis report.

Duke did not include a statement and did not respond to a ask for for remark.

“At Michigan State University (MSU) we consider that variety, fairness and inclusion will have to be upheld at all institutional stages,” read through a statement involved in the Knight Basis report. “MSU Investment Business office consistently seeks to recognize a numerous pool of investment decision resources, however we do not find financial commitment cash centered on identification. MSU is bound by the Michigan Structure as amended by the passage of Proposal 2 in 2006 and upheld by the U.S. Supreme Court in 2014, which prohibits Michigan public universities from supplying preferential remedy to, discriminating against, or defending any individual or group dependent on classifications in the operation of community work, public training, or community contracting. Therefore, each educational and administrative unit at MSU should honor these concepts the MSU Investment decision Place of work is no exception. Even though Proposal 2 stops discrimination and preferential procedure, it in no way negates our ongoing and essential dedication to DEI.”

Inspite of its reduced quantities, Rutgers pointed to the value of DEI in its statement.

“Rutgers University is dedicated to developing a additional diverse, equitable, and inclusive surroundings. The university not too long ago produced its to start with range strategic prepare, which identifies concrete techniques towards charting a extra inclusive route forward that models excellence for the institution. Rutgers acknowledges that there are numerous aspects, including possession, that should be accounted for when evaluating the variety of our financial investment companions. Aspects these types of as the composition of executive management and individuals in expense final decision-earning roles, for case in point, are also critical evaluation parts,” Rutgers claimed in the report. “Diversifying our portfolio increases when getting these concerns into account. An important element of advancing variety in the investment management industry is attained by the recruitment, development, and retention of new professionals. We keep an eye on the variety of our associates at all levels of their companies to realize how they evolve more than time.”

A Absence of Transparency

Exterior observers as properly as all those included with the review criticized the lack of institutional participation, arguing that furnishing these types of facts yields worthwhile expense insights.

“We know that a variety of university leaders are doing the job to identify and include things like superior-carrying out various-owned corporations to take care of endowment resources. But the paucity of trusted information on the possession of financial commitment firms can make it all but impossible to accurately chart development or to inspire reluctant colleges to do much more,” Michael Posner, director of the NYU Stern Heart for Small business and Human Rights, mentioned in a news launch accompanying the review.

Some observers were far more pointed in their criticism.

“While this analyze demonstrates signs of progress, it also illuminates how much we have to go. For just one, 34 institutions, symbolizing $273 billion in assets, declined to participate. It’s absurd that in 2022—when so several establishments have ultimately fully commited to transparency—such a significant range of schools nevertheless refuse to report their variety figures,” Robert Raben, govt director and founder of the Varied Asset Professionals Initiative, claimed in a information launch addressing the interim report.

Raben mentioned by e mail that even for the schools reporting the highest percentage of belongings managed by assorted companies, there had been however a great deal of unanswered inquiries. However establishments this kind of as Stanford and Duke have powerful variety representation in this spot “relative to the industry,” he noted that “we have zero concept what is driving that selection. Is it all or mainly white females? Is it LGBTQ? South Asians? We know from other sources that the numbers for Black and Latino/a supervisors are vanishingly small, which is the main dilemma. So, initially, the universities will need to disaggregate the details so we can see precisely what is likely on.”

Asked about faculties on the other finish of the spectrum that deficiency representation—such as Rutgers—Raben was critical.

“It’s standard, and awful,” Raben wrote. “It possible means … that 93.4% of the whole endowment is managed by white adult men. In what sector is talent almost uniformly distributed only to white adult males? No industry, and asset management’s vestigial exclusions of women and individuals of colour is costing them returns. If you’re not working with all the expertise, you are missing out on returns.”

While the Knight Foundation uncovered limited range among higher schooling asset administration, insights from the Nationwide Association of Faculty and University Organization Officers present a much more beneficial outlook, noting that numerous schools are crafting guidelines to address these issues.

“Over the earlier two many years, we have viewed some slight raise in desire between faculties and universities for working with numerous administrators,” Ken Redd, senior director of analysis and coverage assessment at NACUBO, wrote in an email. “From fiscal 12 months 2020 to 2021, the share of institutions that reported they have a plan of taking into consideration the choosing of expense professionals owned by women or people today of shade grew from 5.8% to 7.7%, in accordance to our NACUBO-TIAA Analyze of Endowment (NTSE) series. The progress was to some degree a lot more noticeable at private faculties and universities, wherever the share with a coverage of contemplating numerous firms grew from 6.8% to 10.2%.”

Extensive-expression developments about variety are unclear, Redd defined, considering that the survey problem has only been provided in the NACUBO-TIAA Examine of Endowment collection for the very last two several years.

Redd encourages establishments looking for to improve range in asset administration to interact their governing boards on the issue and get acquire-in, update their expense tactics to consist of range ambitions, and take into account bringing in exterior consultants who have a sturdy perception of the landscape and can discover various companies.

[ad_2]

Resource backlink

More Stories

What Every Student Should Know About Career Planning

Student Life 101: Managing Stress and Time

Why Every Student Should Learn Time Management