[ad_1]

The Education and learning Department projected that scholar loans would generate $114 billion in earnings in excess of the last 25 years. Even so, a new report reveals that federal scholar loans have really value the governing administration $197 billion, a $311 billion distinction.

The conclusions arrive from a Govt Accountability Office report released nowadays that undermines a narrative from the department that the federal student personal loan plan is producing profits. The analyze, analyzing knowledge on university student loans among 1994 and 2021, observed that the Training Office greatly underestimated how changes to mortgage programs and borrower actions have impacted the federal scholar mortgage harmony.

Latest improvements to the financial loan system since the commence of 2022 that were not included in the analyze, like the General public Company Loan Forgiveness (PSLF) waiver and many team discharges of federal college student personal loan personal debt, will push the expense higher. Also, if President Biden moves to terminate some exceptional student personal debt, the charge would rise as well.

The shift, in accordance to the report, is pushed by adjustments to the federal university student loan application, as effectively as flawed assumptions about borrowers’ earnings, reimbursement costs and default.

Even though the GAO did not present suggestions for the section to increase its budgeting approach, the report highlights essential elements for evaluate that are contributing to massive variations in how considerably the university student bank loan software is basically costing taxpayers.

In a letter to the GAO in response to the report, Under Secretary of Education and learning James Kvaal said, “In some circumstances, estimates are revised since of adjustments in both equally the info available to the office and the department’s methodology for estimating prices.” He continued, “While the office normally strives for the best feasible estimates, there is some inherent uncertainty in the department’s charge estimates, which the department publicly discloses in its Agency Financial Report and the President’s Spending budget.”

The findings of the report have sparked severe pushback from congressional Republicans, who have been remarkably critical of the Biden administration’s alterations to the scholar personal loan method (despite the fact that the report handles decades that Republicans had been in charge of the government as properly as Democrats). “Any way you glimpse at it, the declare that the federal authorities ‘profits’ off pupil mortgage borrowers is untrue. Taxpayers have misplaced hundreds of billions of pounds on this application,” mentioned a statement from a group of Republican lawmakers from both of those the Residence of Associates and the Senate.

What Is Triggering the Variance?

Just about every 12 months the Instruction Division submits an estimate of its costs for the functions of acquiring the federal government’s once-a-year budget. This includes estimates for any new mortgage plans as properly as personal loan efficiency, these kinds of as how numerous debtors are predicted to default or how considerably remarkable personal debt will be paid off.

The division, even so, can’t thoroughly know the true price of the federal university student mortgage program right until the loans are completely compensated off. Therefore, it have to estimate how quickly debtors will pay out back again their credit card debt, how quite a few debtors are envisioned to default and how borrowers’ incomes may well improve in a given calendar year. The report uncovered that considering that 1994, not a solitary group of debtors has totally paid off its debts.

As a result, the Training Department’s estimates are frequently considerably off from what basically takes place in a specified 12 months, the research finds. Inevitably, selected social and economic improvements, this sort of as a economic downturn or a pandemic, are not generally able to be correctly forecast at the commencing of a fiscal yr.

Adjustments in Federal University student Bank loan Courses

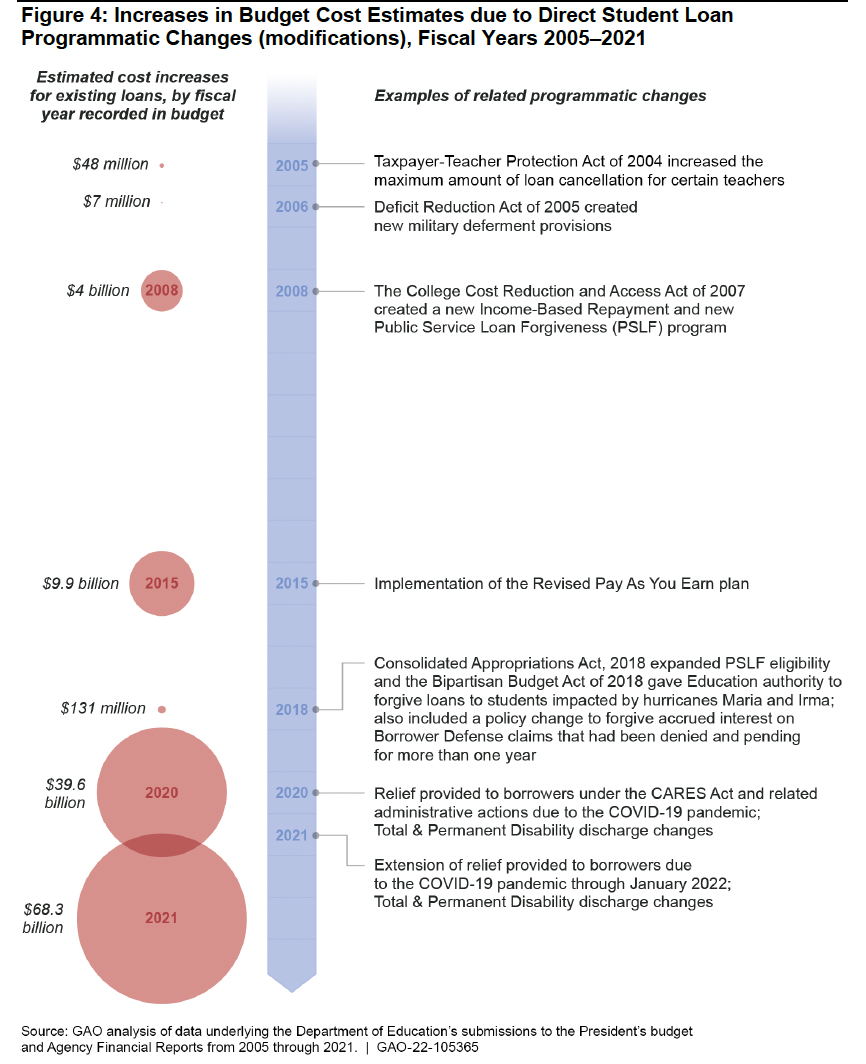

Given that 1997, alterations to the federal pupil personal loan system, together with programs that set certain borrowers on a path toward forgiveness, new reimbursement strategies and the pause on university student financial loan payments that was enacted at the commence of the pandemic, have driven a 33 percent enhance in the cost of the college student mortgage method, totaling $102 billion.

By much, the biggest alter that contributed to this maximize was the pause on federal college student financial loan payments and programmatic modifications enacted throughout the pandemic and other pandemic-similar mortgage forgiveness systems, the report shows. In full, these modifications drove an enhance of above $107 billion in between the yrs 2020 and 2021.

Other improvements integrated the Taxpayer-Trainer Protection Act of 2004, which increased the amount of loan forgiveness that particular instructors could be qualified for, ensuing in a $48 million increase the College or university Cost Reduction and Entry Act of 2007, which re-recognized versions for profits-driven compensation (IDR) and PSLF, resulting in a $4 billion maximize and the Revised Shell out as You Generate prepare, a variety of IDR, ensuing in a $9.9 billion enhance. In whole, these alterations have accounted for a 6 percent boost, totaling $20 billion.

Flaws in Estimates of Borrower Habits

The major driver of the maximize in federal pupil personal loan expenses to the authorities was a hole in available info, the report suggests. Constrained information accessible to the division to estimate how debtors are repaying their loans, how substantially funds borrowers are making and how quite a few debtors will default have pushed a $189 billion raise in charge considering the fact that 1997, in accordance to the report.

The department’s incapability to obtain knowledge on borrowers’ cash flow by way of the Interior Revenue Services has been highlighted as a essential driver of interior issues in administering money-dependent compensation applications, such as the chance that Biden will terminate $10,000 in debt per borrower for people making under $150,000 a year.

Assumptions on borrowers’ compensation program choice by yourself drove a $70 billion maximize. One of the most typical repayment designs, IDR, is specifically complicated to estimate since the quantity a borrower is needed to pay just about every thirty day period changes if they have a adjust in their cash flow. Nearly 50 % of federal college student loans, 47 percent, are currently being repaid via IDR.

Moreover, alterations to borrowers’ estimated revenue advancement induced a $68 billion improve, and assumptions on how quite a few borrowers will default brought on a $23 billion enhance.

Alterations to the Instruction Department’s Funds Design

The Education Section is presently in the system of introducing a new funds model that will be applied in fiscal year 2026. The current model is centered on estimates of huge teams of borrowers, though the new design, known as the microsimulation design, will choose into account data from the National University student Loan Facts Program.

In accordance to details delivered by the division in-depth in the report, this new spending budget product will present a lot more exact predictions of adjustments driving value to the federal scholar loan application.

Agent Robert Scott, a Democrat from Virginia and chair of the House Committee on Education and Labor, stated in a assertion, “Regrettably, this GAO report shows that the soaring charge of college—caused by a long time of state disinvestment in higher education and learning and the declining price of the Pell Grant—has compelled students to borrow a lot more funds for a diploma. In contrast to past generations, students are now taking out loans in quantities which make repayment challenging.”

[ad_2]

Resource link

More Stories

Rethinking Traditional Methods in Education Systems

The Importance of Emotional Learning in Education

The Role of AI in Revolutionizing Education