[ad_1]

svetikd/E+ via Getty Images

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on April 30th.

REIT Rankings: Student Housing

Hoya Capital

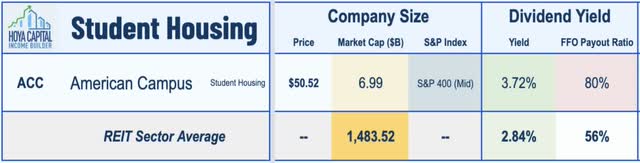

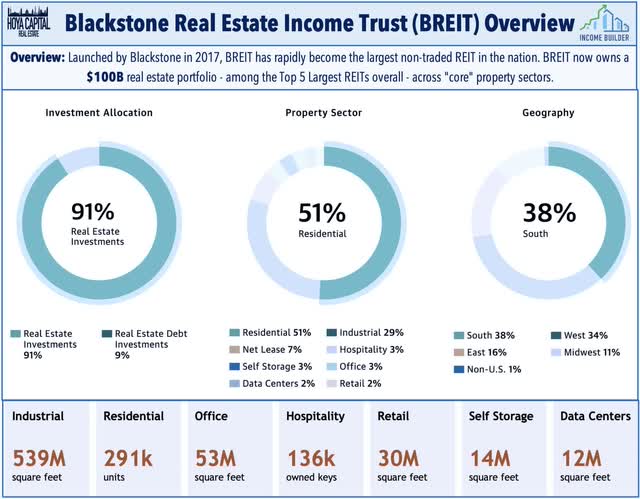

Student housing has seen a swift recovery and brightening outlook over the past twelve months as the effects of soaring rents have more-than-offset ongoing COVID issues and longer-term enrollment headwinds. American Campus Communities (NYSE:ACC) – the first of three student housing REITs to go public and the last one still publicly traded – was scooped up last week by Blackstone (BX) in one of its five major REIT acquisitions since last June to feed its fledging non-traded REIT (“NTR”) business, Blackstone Real Estate Income Trust (“BREIT”). The takeover of ACC – which went public back in 2004 – marks the end of the relatively successful era of publicly-traded student housing REITs and follows Greystar’s 2018 acquisition of EDR and Harrison Street’s 2015 acquisition of Campus Crest.

Hoya Capital

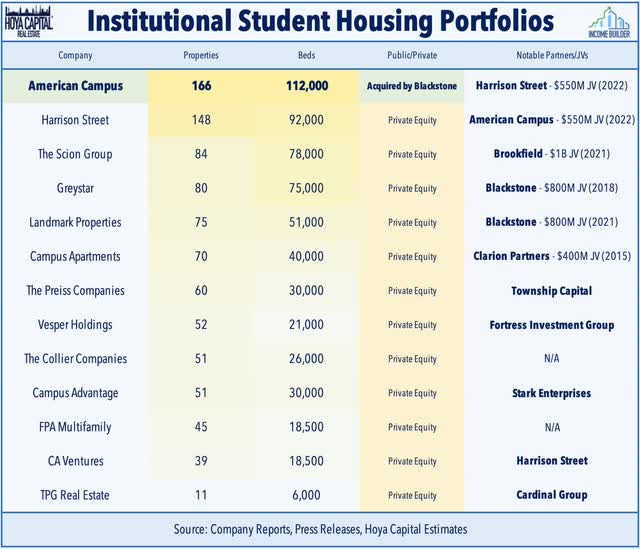

Since its IPO nearly two decades ago, American Campus has been the pioneer of the institutional student housing ownership and development model. Apart from Blackstone, several other publicly-traded real estate asset managers own – or recently owned – student housing portfolios including Brookfield Asset Management (BAM) – which owns 53 student housing properties primarily in the UK. A handful of other publicly-traded REITs own relatively small portfolios of purpose-built student housing assets and/or traditional rental housing in college towns including W. P. Carey (WPC) along with several apartment REITs. Other major institutional owners of student housing portfolios include Harrison Street, The Scion Group, Greystar, The Collier Company, and TPG Real Estate.

Hoya Capital

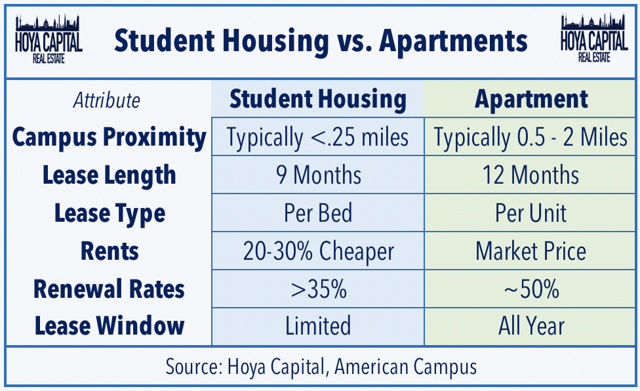

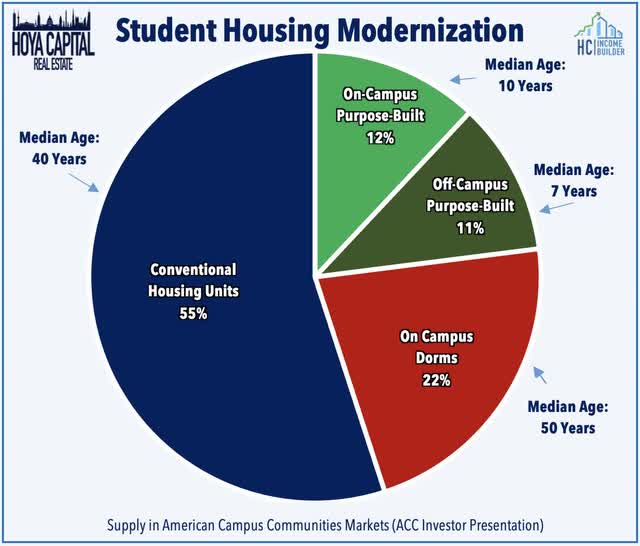

Student housing emerged as a full-fledged institutional asset class over the last half-decade as institutional capital has flowed into the sector in search of a counter-cyclical asset class with a unique and uncorrelated return profile. The NMHC estimates that there are approximately 8.6 million students in the United States that rent housing near campus. Nationwide, roughly a quarter of students live in university-owned on-campus dormitories, while another quarter live in purpose-built off-campus housing. The remaining 50% rent other types of non-purpose-built rental housing near campus. Purpose-built student housing facilities are generally cheaper and are equipped with more applicable amenities for students than typical off-campus housing facilities.

Hoya Capital

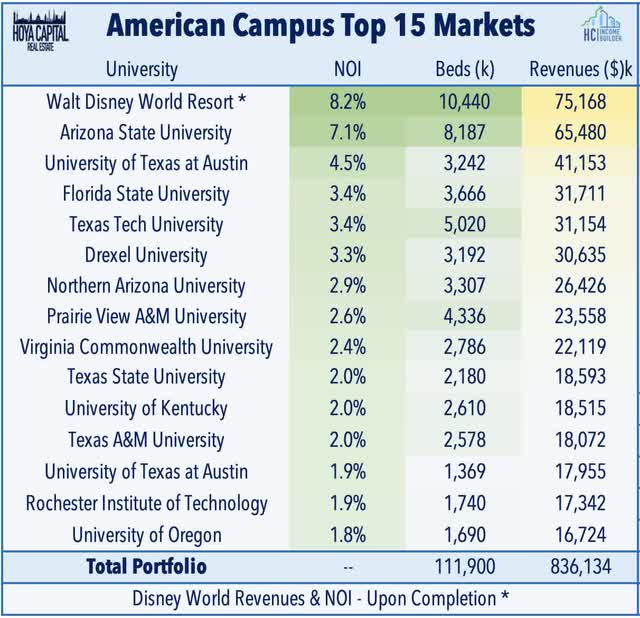

American Campus owns a portfolio of roughly 112,000 student housing beds with a primary focus on highly-selective flagship universities across Sunbelt markets consisting of high-value on-campus or near-campus purpose-built student housing facilities at major flagship 4-year public universities. ACC is also currently developing more than $10k beds for Disney (DIS) College Program which, upon completion in 2023, will be ACC’s largest market while ACC recently completed a multi-year “strategic portfolio refinement” in which it sold $2B in non-core assets that were generally older facilities at smaller universities and further from campus. Since completing its strategic portfolio refinement in late 2018 through the end of March before the acquisition announcement, ACC had outperformed the broad-based Vanguard Real Estate ETF (VNQ) by roughly 1.5 percentage points annually.

Hoya Capital

End Of Student Housing REIT Era – For Now

Given the abundance of private institutional capital targeting student housing assets, we added ACC as a “Strong Buy” to the REIT Focused Income Portfolio back in January and noted the possibility of a take-out “with a projected price around $65.” Nearly spot-on with that call, Blackstone’s $12.8 billion takeout at $65.47/share bid is a healthy 14% premium to ACC’s prior close. The deal preceded another Blackstone acquisition the following week of industrial REIT PS Business Parks (PSB) and followed acquisitions over the past ten months of residential REITs Preferred Apartment (APTS) and Bluerock Residential Growth (BRG), along with data center REIT QTS Realty (QTS).

Hoya Capital

These massive acquisitions have become necessary to feed its fledging non-traded REIT, BREIT. Launched back in 2017 to complement Blackstone’s massive real estate empire now valued at nearly $1 trillion, BREIT has rapidly amassed a $100B portfolio which now includes over 300,000 housing units, 135,000 hotel rooms, 500M square feet of industrial space, 50M SF of office space, and over 10M sq of storage and data center facilities. The $100 in gross asset value – the vast majority of which has been acquired over the past five years alone – places BREIT among the five largest REITs alongside Prologis (PLD), American Tower (AMT), Crown Castle (CCI), and Equinix (EQIX).

Hoya Capital

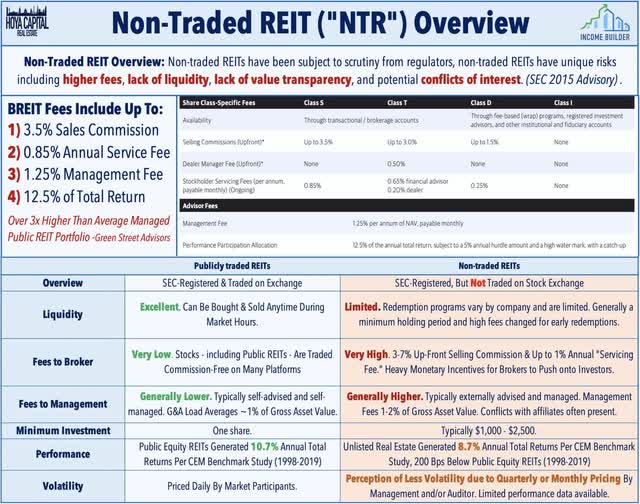

While we think BREIT is an excellent fee-generating business for its parent, Blackstone, we’re skeptical of the economics and efficiency for BREIT’s end investors. Non-traded REITs – which are typically promoted to investors by broker-dealers that receive hearty up-front commissions of 3-7% and “trailers” of up to 1% annually – have rightfully been subject to heavy scrutiny from regulators due to their high fee structure, lack of liquidity, and prevalent conflicts of interests. While BREIT may be the “best of the bunch,” non-traded REIT managers have, for decades, capitalized on investor interest in private real estate vehicles based largely on the (likely faulty) notion that private real estate doesn’t exhibit the volatility of public REITs simply because it is priced less frequently and in a substantially less transparent manner.

Hoya Capital

Student Housing Fundamentals

This report will likely be our final quarterly student housing report until the tides shift and we see these portfolios come back into the public markets, but it is nevertheless important to monitor broader industry trends given its parallels to the broader residential REIT sector. As noted, student housing assets are riding a swift recovery and brightening outlook over the past twelve months as the effects of soaring rents have more-than-offset ongoing COVID issues and longer-term secular headwinds on enrollment. RealPage reported that student housing rents are showing an “unprecedented growth rate” in pre-leasing for the Fall 2022 semester with annualized rent growth of 5% which is double the average rent growth achieved through the 2010s.

Hoya Capital

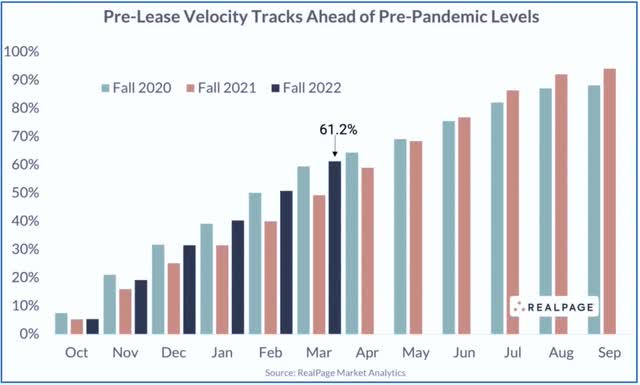

RealPage also reported that overall pre-leasing occupancy rates have climbed to record-highs for the Fall 2022 semester. Fall 2022 pre-lease velocity among the RealPage 175 set of campuses through March (61.2%) – the highest on record – and well ahead of the pre-pandemic 2020 (59.5%) level. Powering the strong performance is a recovery in enrollment growth at top universities to the highest level since 2017. After seeing enrollment growth rates of 0.5% or less from 2018-2020, RealPage noted that enrollment growth exceeded 1% in the Fall 2021 semester and appears likely to accelerate further into 2022.

Hoya Capital

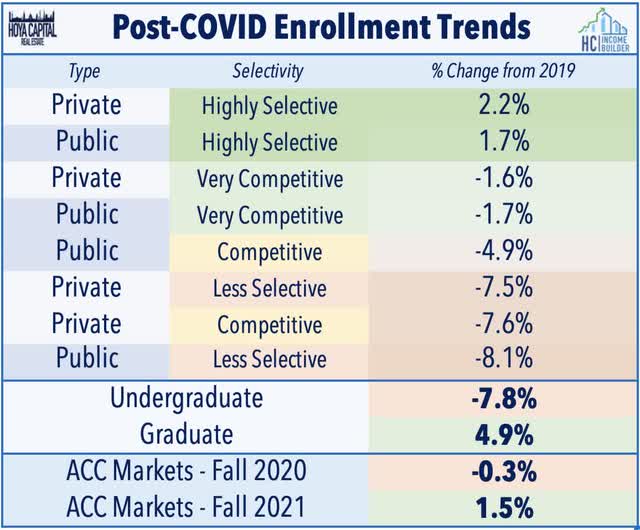

Consistent with the aforementioned RealPage report, despite the broader enrollment declines at the national level due to a myriad of short-term pandemic-related effects and structural headwinds related to demographics and the shift to online education, student housing fundamentals in top-tier university markets have returned to pre-pandemic levels. Per recent data from National Student Clearinghouse, enrollment at highly selective schools – which ACC targets – has actually increased from pre-pandemic levels, and recent data suggest that momentum is building into the 2022 academic year.

Hoya Capital

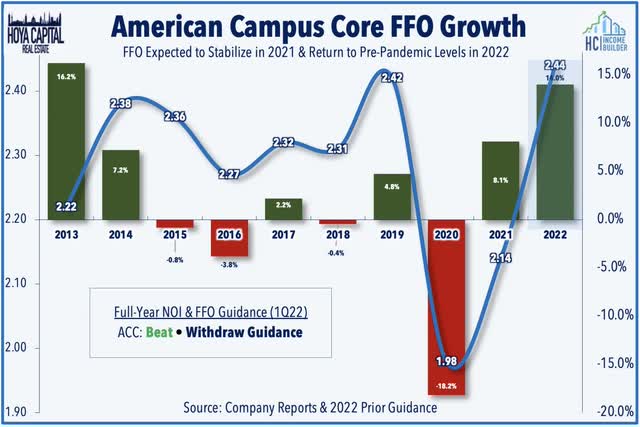

Riding this student housing recovery, American Campus reported impressive Q1 results, citing strong enrollment trends at tier-one universities and limited supply growth. ACC recorded same-store Net Operating Income (“NOI”) growth of 14.3% from last year as same store revenues increased 10.0% percent and operating expenses increased 4.3%. While its full-year outlook was withdrawn due to the pending acquisition, ACC had previously expected its FFO to fully recover to pre-pandemic levels this year and in its last earnings call, CEO Bill Bayless commented that ACC is “experiencing the most substantial fundamental tailwinds we’ve seen in many years.”

Hoya Capital

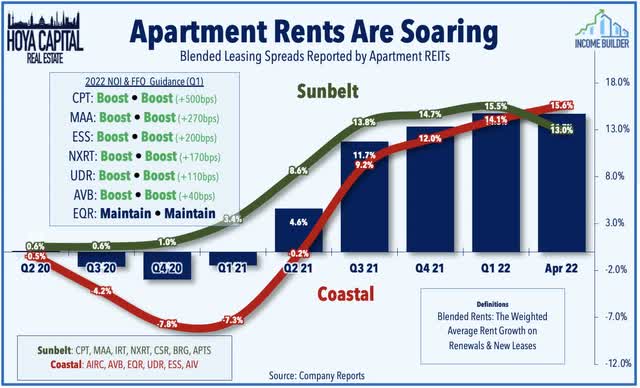

As discussed in our Earnings Halftime report last week, strong results from ACC were consistent with a slate of stellar results across the residential REIT sector as rents across essentially all property types and regions continue to soar with no signs yet of slowing down. With the majority of ACC’s portfolio comprised of off-campus housing units – unaffiliated with a university – there should be an implicit level of “fungibility” or correlation with the broader non-purpose built housing stock that had appeared to be under-appreciated by the market based on its pre-acquisition valuations. Among the seven apartment REITs to report results thus far, blended rent growth accelerated to nearly 15% in Q1 – a fresh record-high – and up from 13% in the prior quarter.

Hoya Capital

It’s Not Goodbye – It’s See You Later?

Back in January, we initiated a position in American Campus in the REIT Focused Income Portfolio based on the improving trends we observed across the student housing sector and on the potential for a takeout given the ample amount of institutional capital targeting student housing assets. Nearly spot-on with that call, Blackstone’s takeout at $65.47/share bid – which is expected to close in Q3 – is a nice “win” for investors but is also bittersweet given the fact that it marks the end of a relatively successful era of pure-play publicly-traded student housing REITs. Given the inherent competitive advantages for investors of the public REIT model, we think that the tides will eventually shift back in favor of publicly-listed REITs over their less-investor-friendly non-traded REIT peers, so we’ll continue to keep the student housing industry on our radar in expectations of an eventual reunion.

Hoya Capital

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

[ad_2]

Source link

More Stories

What Every Student Should Know About Career Planning

Student Life 101: Managing Stress and Time

Why Every Student Should Learn Time Management